Berlin seems to be the perfect climate for entrepreneurs. From the newly launched FinTech startup solarisBank to increasingly popular Number26, startup culture in the German capitol is a powerful force. Despite London leading the pack in FinTech, Berlin is emerging as a real competitor, whose FinTech sector continues to grow at rapid speed. Though the self-titled “Silicon Allee” is no doubt blossoming, there seems to be uncertainty as to why. What’s driving FinTech in Berlin and will it make it to the number one spot?

The Banking Atmosphere

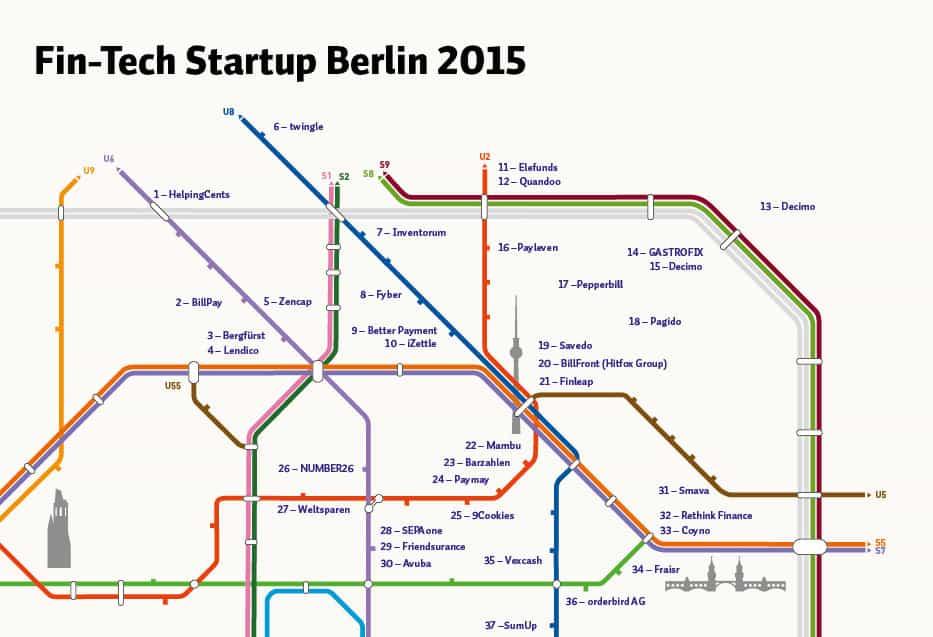

It’s almost a surprise to see Berlin grow in the FinTech scene. Unlike London or New York, Berlin doesn’t host any major banks or stock exchanges. It doesn’t even have a large—or medium—number of venture capital firms. Still, Berlin is home to several successful FinTech companies. One of the biggest is online bank Number26, which has accumulated over $10 million in funding. They reached 80,000 clients in only ten months, and have received a lot of love in their home country. Other players, like Bitbond, Raisin, and Zencap are still only the tip of the iceberg. Local Berlin-based FinTech builder Finleap has also grown, employing over 100 people in eight FinTech businesses—and it only started a little over a year ago.

While traditional banks in the US are, to an extent, still fighting to keep up, German banks have a certain instability that make the financial climate of Germany perfect for FinTech. Regional banks lack IT competency and are struggling to get with the technological times. The result is a population willing to look to alternatives, and also major companies willing to enlist outside help. Commerzbank, German’s second largest bank, has a Main Incubator (located in Frankfurt), as well as CommerzVenturies entities, which focuses on FinTech. Deutsche Bank, on the other hand, has opted to create incubators in London, Silicon Valley, and Berlin. Companies like Deutsche Bank have been hit hard lately for not being ready to go digital, and their response has been increasingly favorable for FinTech endeavors in the country.

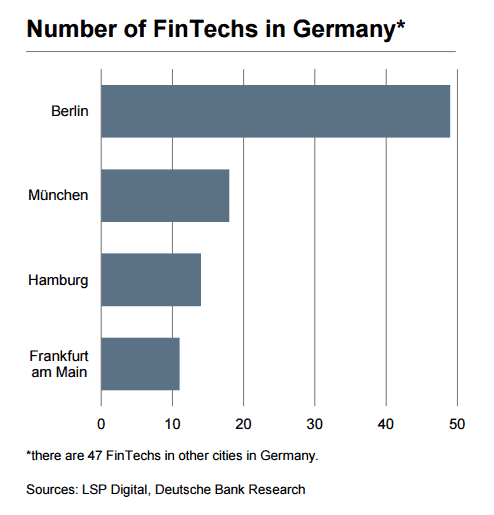

While banks are scattered across Germany, Berlin is deemed the German FinTech capital—even by Deutsche Bank. They wrote a paper repeatedly saying so, with a host of statistics to back them up. Berlin hosted 139 FinTech firms in 2014, followed by Munich, who had less than 20. Frankfurt claimed only 11. They found that 56% of German banks collaborated with FinTech firms for strategy, and a whopping 80% were satisfied with that partnership. Perhaps the question isn’t simply “what makes Berlin so great for FinTech.” Rather, Germany as a whole is embracing the movement, and Berlin has proven the perfect city for startups to enter the playing field.

Money in the “Poor but Sexy” Capitol

How did Berlin get here with so little funding and an obvious lack of structure? Many believe this “lack” may be exactly why startups and FinTech are succeeding in Berlin. Mathias Ockenfels, investment associate at Berlin Point 9 Capital explains “there is no old-fashioned industry in Berlin, but some of the tech companies are the largest employers here.” Many point to the fall of the wall and the missing business infrastructure as a real cause for the appearance of startups. Moreover, Berlin boasts one of the most multicultural scenes imaginable. Unlike Paris or other EU cities, internationals are the norm, and all kinds of languages are spoken.

The famous, unofficial motto of Berlin, “poor but sexy,” may also lend insight. Berlin is a hotbed of young internationals. It attracts artists, travelers, and even techies. Of course, if Berlin the embodiment of “poor but sexy,” that’s exactly where love for FinTech would be expected to grow. The “underbanked” and tradition-wary are exactly the type of individuals who make up Berlin. The city is even known for its strong cryptocurrency community. Bitcoin may not be thriving, but the community and love for digital currency is burgeoning rapidly. Berlin is home to Bitcoin startup incubator Bitcoins Berlin, the world’s first bitcoin-accepting bar, popular bitcoin podcasts, as well as strong meetup groups and many members of the Federal Association of Bitcoin.

The place where Berlin truly struggles is funding. Germany is known for being very averse to risking money, and venture does not simply flow in and out of startups the way it does in Silicon Valley. That’s likely why money has to be found elsewhere, which seems to be working. A study from FinTech Forum found that Germany was barreling ahead in FinTech funding, raising between $300 and $350 million, again second to the UK with $540 million.

Though Berlin remains “second” in Europe, it is making a huge name for itself, attracting much more venture capital out of foreign investors, and prompting some to relocate or establish new businesses in the capitol. Their famed know-how even brought one Irish minister of state to seek advice from the Berlin FinTech scene. A published 54-page strategic report on Ireland’s international financial sector (IFS) hinted at trouble in Ireland, so Simon Harris, Ireland’s Minister of State at the Department of Finance, hoped that empowering the local FinTech startup scene would be help remedy it. For advice, he went to Berlin digital venture capital firm Earlybird, and other local FinTech players. By seeing what makes Berlin such a powerful FinTech hub, he hoped to help boost Ireland’s own startups.

Hopefully the influx of big name incubators and a better flow of venture capital will push FinTech in the German capitol ahead even faster. Though Berlin continues to attract attention, it will also fight some of its own home-grown problems—including copyright and data protection laws. Still, many FinTech companies are fighting through the muck and making Berlin into one of the biggest hubs for financial technology. London may be larger, but growth in Berlin is massive. According to Roland Berger, startups in the German hub have grown almost 7 times faster than that of London. The winds in Europe may be changing—or at least slowly evening out.

image credit: Jörg Schubert

Like this article? Subscribe to our weekly newsletter to never miss out!