Here is what “The State of European Tech 2018”, a data-driven analytical report by Atomico reveals about the factors that are accelerating the growth of tech in the European economy

The comparison of Europe’s tech scene with Silicon Valley in the U.S and Asia (particularly China) has been a topic of debate for long criticising not only the lack of consumer-tech companies in

Amidst this cynicism, there are numbers which tell a story of constant progress in the European tech economy and break many myths of the past. Lack of VC funding is not a problem anymore and tech workforce in EU is on the rise. The State of European Tech 2018, a data-driven analytical report by Atomico states that while Europe’s overall economy and traditional industries are stuck in the doldrums, booming tech represents the best hope for growth. Tech firms are powering job creation and ambitious founders are tackling some of the world’s biggest problems. All of that has members of the ecosystem optimistic – except in the U.K. where sentiment is not at the same levels as elsewhere.

Some of the key findings of the report mention:

- The amount invested in Europe’s technology ecosystem is $23bn in 2018, up from just $5bn in 2013.

- There were four tech IPOs or direct listings of European tech companies in 2018 that reached valuations of more than $5B on opening day, including Europe’s largest ever venture-backed publicly-listed tech company, Spotify.

- In total, Europe contributed three of the top 10 largest tech IPOs globally of 2018.

Chris Grew, Partner, Technology Companies, Group Orrick says, “There has been a nearly five-fold growth in European venture capital investment in the last five years. There are five times the number of unicorns – with at least 17 new billion dollar plus companies added in the past year alone. The European tech sector has produced nearly four times the job growth rate of the general economy, resulting in a talent pool of programmers and STEM researchers surpassing that of the United States. At Orrick, we see it in our practice every day as we have helped founders, investors and corporate venture clients raise or deploy more than $3.7 billion across Europe over the past year.” He mentions that as a global tech law firm, they are not surprised to see investors from around the world chasing strong returns from their European investments. While U.S. investment returned to 2016 levels after another record-breaking performance last year, investment from Asia continued to grow.

Here are the factors (according to the report) driving this high growth for European tech:

Powering Workforce Growth

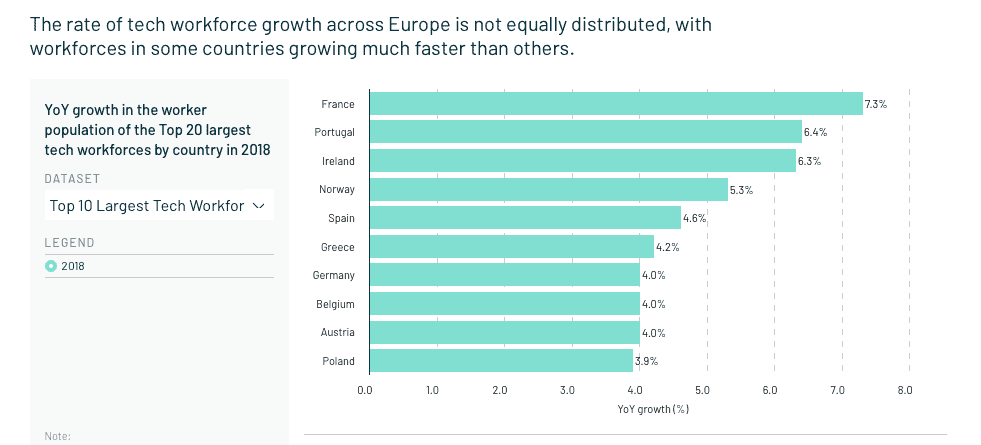

Tom Wehmeier, Partner, Atomico says, “Last year we found that Europe was experiencing a ‘Battle Royale’ for talent. This year was the year Europe figured out how to effectively mobilise its deep pools of talent. The tech sector is attracting more participants – whether measured by the healthy increase in professional developers or the uptick in talented executives moving into tech from other sectors. What is interesting is that the developer pool is growing fastest outside those countries that have historically attracted the most investment: Turkey, Spain and Russia’s pool of developers have been deepening the most rapidly. All this will lead to a massive potential upside for the wider European economy as capital eventually grows into these new communities,” he says.

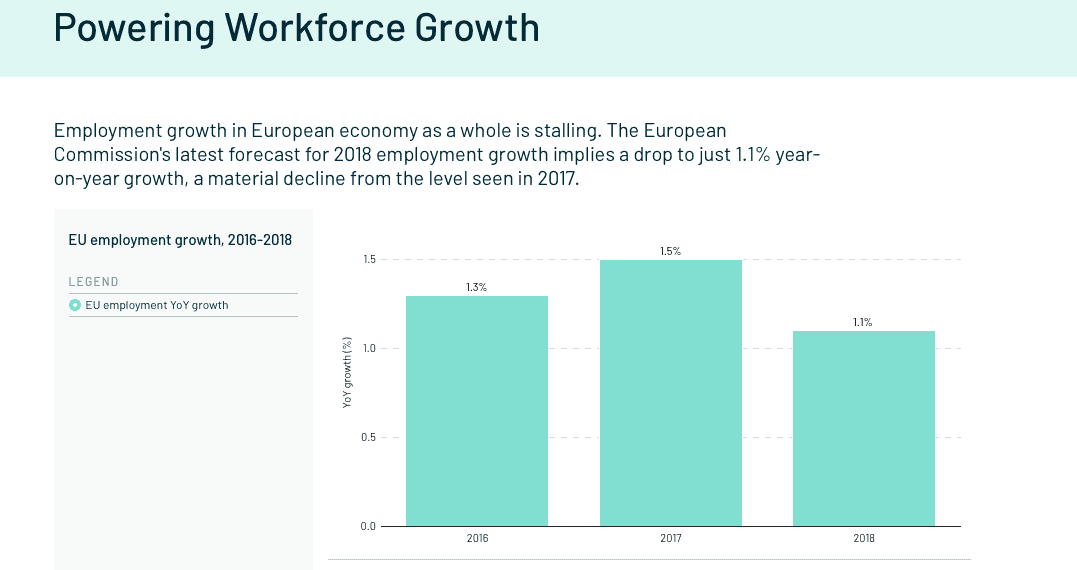

Employment growth in the European economy as a whole is stalling. The European Commission’s latest forecast for 2018 employment growth implies a drop to just 1.1% year-on-year growth, a material decline from the level seen in 2017. On the other hand, Europe’s tech workforce grew 4% in 2018. It is worth comparing the EU employment growth rate to the remarkable worker population growth that powers the European tech industry.

Within Europe, the French tech worker population is growing significantly faster than Germany and UK. The rate of tech workforce across Europe is not equally distributed, with workforces in some growing much faster than others. France, for example, hit 7.3% growth in 2018, making it comfortably the fastest growing tech workforce in EU.

Tech: The Motor for GDP Growth

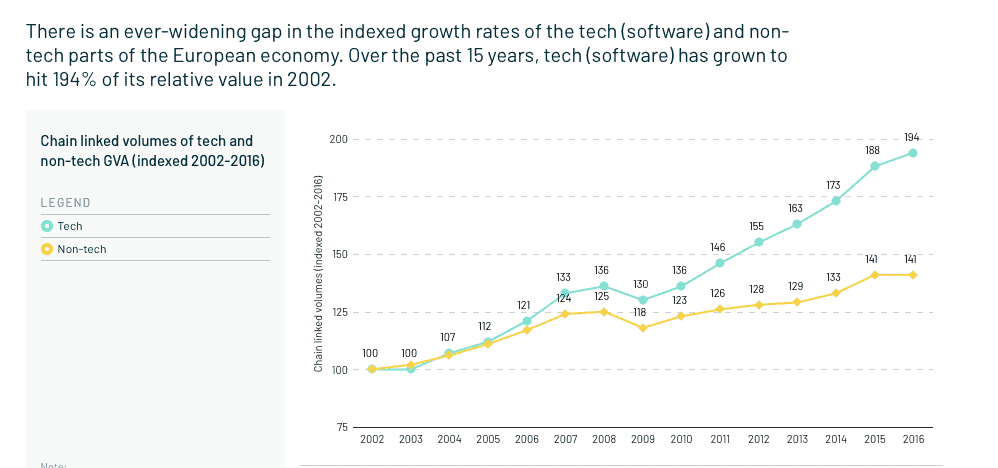

There is an ever-widening gap in the indexed growth rates of the tech (software) and non-tech parts of the European economy. The implication of this sustained difference in growth rates is starkly visible when looking at indexed growth of the tech parts of the European economy. Over the past 15 years, tech (software) has grown to hit 194% of its relative value in 2002. Europe’s software industry growth dramatically outpaces the rest of the European economy.

Today, the European tech (software) industry is now growing 5x faster than the rest of the economy. Over the last 10 years, many of these traditional industries upon which the European economy is so dependent have either stagnated or declined, undermining the overall rate of growth in European Gross Value Added.

The European tech (software) industry contributes around $400 billion to the European economy today, remains just a fraction of total European Gross Value Added, accounting for just 2.5 % of total European GVA.

Smiles (almost) all round in European tech

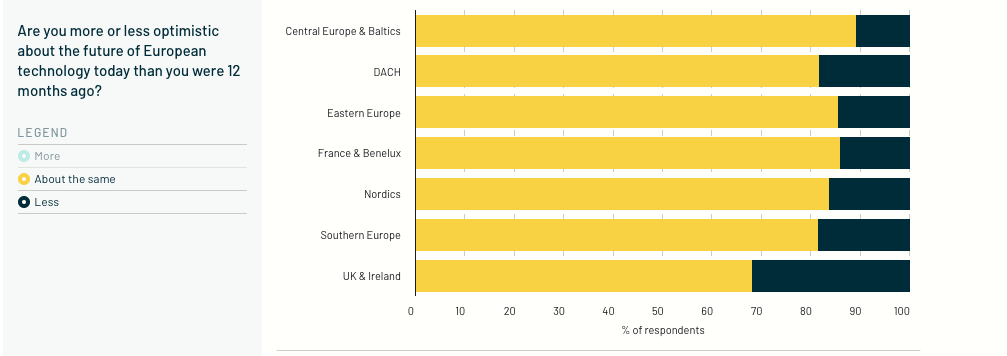

Europe’s tech ecosystem remains characterised by a strong level of growing optimism about the future. This increase in optimism is most evident in Eastern and Southern Europe

where there is real momentum. The UK, perhaps unsurprisingly, registered the largest downturn in optimism by a wide downturn in optimism by a wide margin. There continues to be a very strong sense of optimism across the European tech ecosystem

90 per cent of the European tech community is either more optimistic about the future of European tech or maintain the same levels of optimism compared to 12 months ago. This remains the same as in 2017 when 91% of respondents were more optimistic or the same.

“ I’m definitely more optimistic than 12 months ago. I think we’re seeing a marked shift in ambition in Europe, and crucially, that’s being matched at an investor level. What’s more, the increased cost of living and hiring competition seems to have taken the blinkers off a lot of Valley-bound entrepreneurs. This can only benefit Europe.” says Rosie Dallas, Fat Llama.

Tech for Good: A European Opportunity?

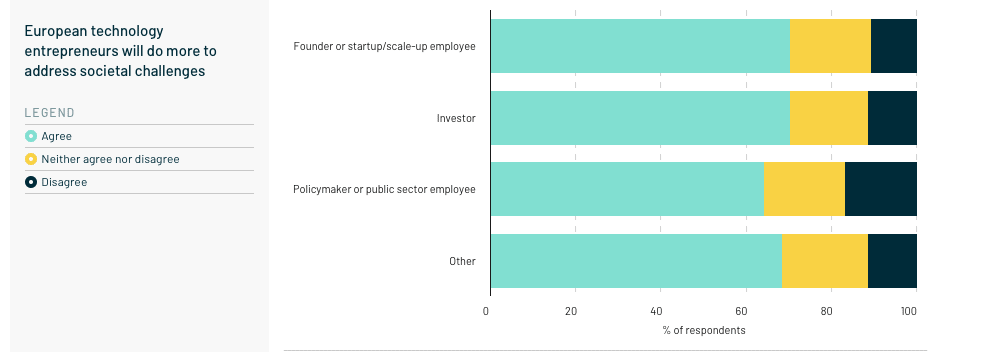

There is strong agreement across all stakeholders, including within the public sector, that European tech entrepreneurs will have a bigger impact than European governments when it comes to solving important global challenges. 64 % of the public sector and policymaker respondents who agree that European technology entrepreneurs will do more to address major societal challenges than European governments.

“ Compared to the US, we seem to be a bit further ahead when it comes to sustainability. Especially when it comes to food waste and climate consciousness, both among consumers and within the food industry..Compare this with President Trump’s decision to withdraw from the Paris agreement a year ago…One thing that has influenced us at Karma is that we’ve had mission-driven, competent and successful entrepreneurs, such as Niklas Adalberth founding Norrsken Foundation, drive the agenda of using entrepreneurship to build technologies that can solve social challenges on a global scale,” says Elsa Bernadotte from Karma.

Final Thoughts

Tom Wehmeier, Partner, Atomico leaves us with a word to the naysayers and critics of European tech: irrespective of the huge strides European tech has taken in the last few years, our tech sector will continue to be compared to the performance of Silicon Valley. ”For a long time, US VC has outperformed European VC in terms of portfolio returns, but that is increasingly untrue. The latest historical performance data shows that European venture has been outperforming US venture in recent horizon periods. We believe this is a bellwether for a changing landscape. Let’s not forget that 95% of the value creation of today’s US tech sector is from companies founded 15 years ago or more and that the early tech successes of ARM, Amadeus and Ocado were not venture-backed. Given that 21 European companies have been founded and scaled to billion-dollar-plus valuations with the support of venture capital since 2010 alone, we are confident that Europe has caught up on North America’s head start, “ he concludes.

Disclaimer: The content of this article is based on a section of The State of European Tech report. The full report can be downloaded here.