Blockchain technology has emerged as a transformative force, revolutionising industries, and paving the way for new possibilities in the digital landscape. Germany, known for its prowess in technological advancements and innovation, stands at the forefront of the blockchain revolution. As this decentralised technology continues to evolve, it is crucial to gain a comprehensive understanding of the German blockchain ecosystem, its key players, and the developments shaping its future.

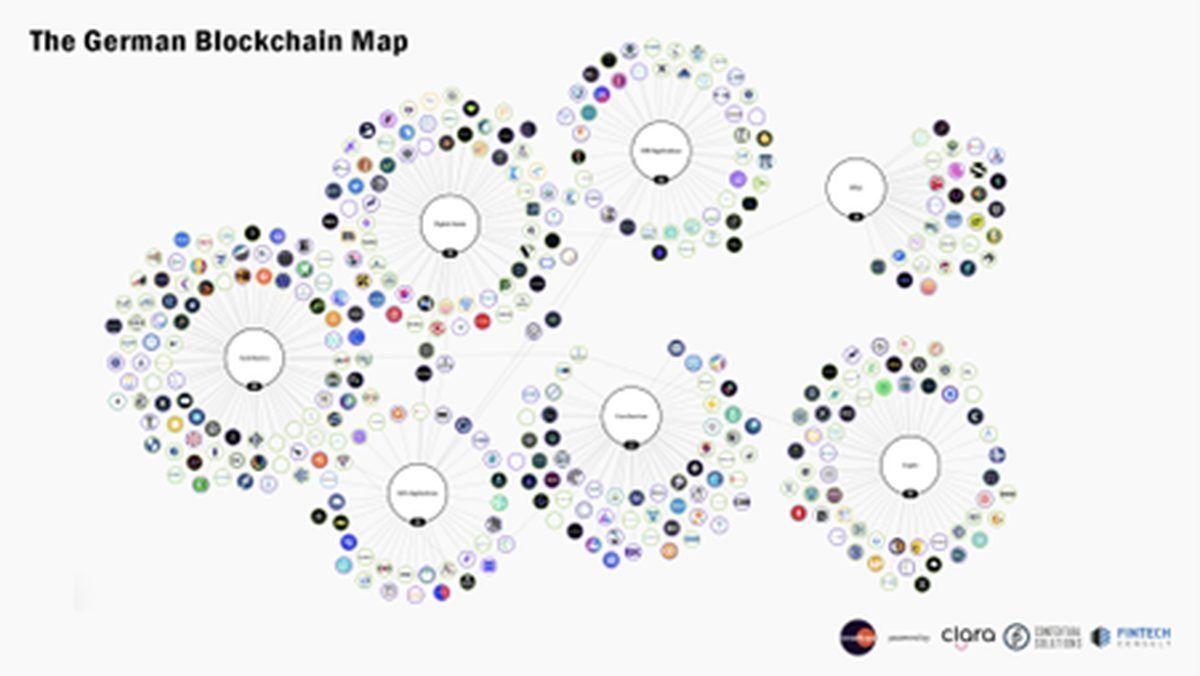

The InnoMaps Blockchain Map is designed to facilitate a dialogue among blockchain entrepreneurs, service providers, and enablers, laying the foundation for a thriving blockchain community in Germany.

As we delve into the German Blockchain Map, we embark on a journey through time, witnessing the development and growth of blockchain technology across different hubs within Germany. By examining the key insights gleaned from this map, we gain valuable insights into the evolving landscape of blockchain innovation, unlocking a deeper understanding of the industry’s trajectory in Germany.

Join us as we explore the German blockchain ecosystem, unravel the stories behind its vibrant players, and uncover the driving forces that have propelled this technological revolution forward. Through this exploration, we aim to illuminate the past, present, and future of blockchain in Germany, offering valuable insights into the transformative power of this groundbreaking technology.

The high-tide mark for Blockchain startups

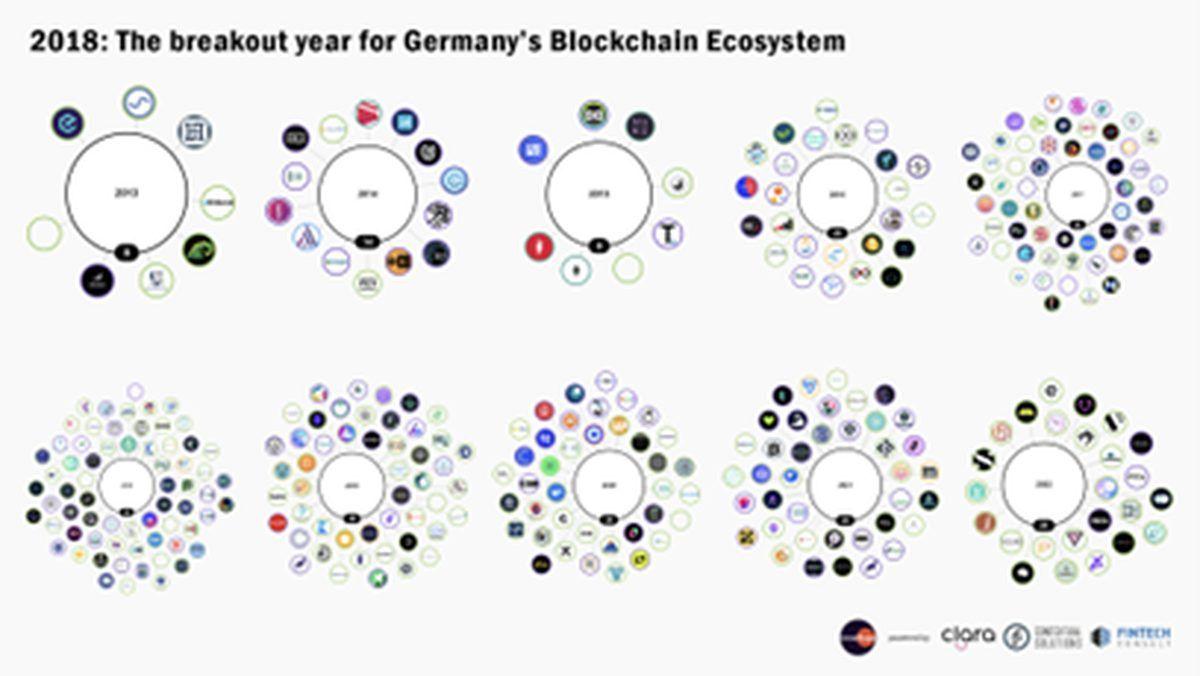

Looking at the number of blockchain startups incorporated each year across Germany, it’s clear to see that 2018 was a remarkable moment in history, with a staggering 66 new entrants to the market – up from an underwhelming 8 just three years before.

There are a number of factors which contributed to this performance:

- Regulation of Initial Coin Offerings (ICOs): In February 2018, the German Federal Financial Supervisory Authority (BaFin) published guidelines on how tokens issued through ICOs would be classified and regulated. This move provided clarity and transparency for companies and investors engaging in ICOs, fostering confidence in the market.

- Crypto asset classification: In March 2018, BaFin released a classification of cryptocurrencies as financial instruments. This classification brought cryptocurrencies under existing regulatory frameworks, providing a clear legal status for various tokens and fostering investor protection.

- Blockchain strategy by the German government: In June 2018, the German government published its national blockchain strategy, emphasizing the importance of blockchain technology for innovation and economic growth. The strategy aimed to position Germany as a leading hub for blockchain development and implementation, attracting both domestic and international players.

- Acceptance of Bitcoin as a means of payment: Throughout 2018, an increasing number of businesses in Germany started accepting Bitcoin as a payment method. This broader acceptance helped promote cryptocurrency usage and mainstream adoption, showcasing the practicality and potential of cryptocurrencies as a medium of exchange.

- Rising interest from traditional financial institutions: In 2018, traditional financial institutions in Germany began showing a growing interest in blockchain technology and cryptocurrencies. Banks, investment firms, and stock exchanges started exploring the integration of blockchain solutions and offering cryptocurrency-related services. This recognition from established financial players contributed to the credibility and acceptance of blockchain and cryptocurrencies in the country.

- Growing crypto community and events: The German blockchain and cryptocurrency community witnessed a surge in events, conferences, and meetups in 2018. These gatherings provided platforms for networking, knowledge sharing, and collaboration, fostering the growth of the ecosystem and generating awareness among the general public.

There was significant momentum behind blockchain-based solutions and cryptocurrency throughout 2018, both from official and unofficial channels. This spawned an impressive wave of innovative ideas and entrepreneurial activity.

The question remains, how much of that activity was lasting? How closely does the ecosystem of 2018 resemble the landscape we see today?

The end of the beginning, not the beginning of the end

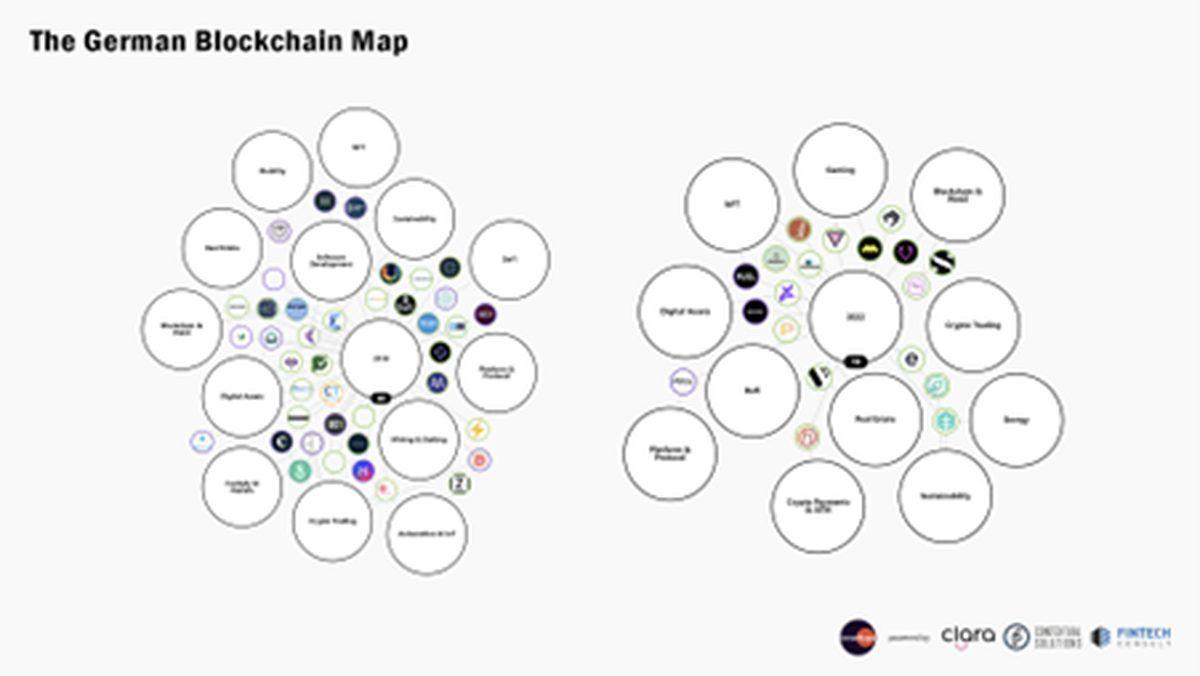

At first glance, it may seem like the enthusiasm for blockchain technology has fallen off in 2022, with just 25 companies incorporated compared to the highs of 2018. Interest and expertise is being focused into fewer sectors, as illustrated by the graphic above. Digital Assets, NFTs, Gaming and Web3 all led the way in 2022, and are likely an indicator of where interest in blockchain lies for the near future.

What we’re seeing in this shift is likely characterised by the slide down from Gartner’s infamous ‘peak of inflated expectations’ and towards the ‘plateau of productivity’. Enthusiasm can only carry a startup so far, and at some point, reality bites and the market shifts – but that’s good news for the companies with serious solutions.

Amongst the main reasons for this apparent fall in activity are the following:

- Market maturity: The blockchain industry has experienced significant growth and development since 2018, resulting in increased market maturity. As the industry matures, it becomes more challenging for new startups to enter and compete with established players. The barriers to entry may have increased, leading to a slowdown in the creation of new startups.

- Regulatory uncertainty: Despite the progress made in regulatory frameworks, the blockchain industry still faces some regulatory uncertainty. Regulations surrounding cryptocurrencies, ICOs, and digital assets can vary and evolve, which may have created a more cautious environment for new startups. Uncertainty in regulations can deter entrepreneurs from venturing into the blockchain space.

- Market consolidation: In a maturing industry, market consolidation is a common phenomenon. Established companies may acquire or merge with smaller startups, leading to a reduction in the number of independent entities. This consolidation can result in a perceived slowdown in the creation of new startups, as the industry experiences a shift towards larger, more established players.

- Funding challenges: While there was significant investment activity in the blockchain space in 2018, the investment landscape may have changed since then. Investor sentiment and preferences can fluctuate, impacting the availability of funding for new startups. If funding becomes more challenging to secure, it can contribute to a slowdown in the creation of new blockchain startups.

- Technology development focus: As blockchain technology itself evolves, there may be a shift in focus from creating new startups to further developing existing solutions. Established companies and organisations might prioritize refining and implementing blockchain technology rather than launching entirely new ventures. This shift in focus could lead to a perceived slowdown in new startup creation.

There’s still plenty of reason for optimism, as we move further away from the unreasonable expectations which created the high-tide mark in 2018, investors, customers and partners are increasingly open-minded about genuinely practical use cases for blockchain technology. There’s less hype to colour the discourse, and drive attention away from the more boring – and useful – applications.

The future opportunities for blockchain in Germany

The German market holds a number of clear opportunities for blockchain technology, and founders who can tap into these opportunities (and weather the current adverse fundraising environment) have the chance to tap into a number of industries, including the following:

- Financial Technology (Fintech): Germany has a strong financial sector and is home to numerous banks and financial institutions. Startups can leverage blockchain technology to offer innovative solutions in areas such as cross-border payments, remittances, decentralized finance (DeFi), asset tokenization, and smart contracts. By providing secure, transparent, and efficient financial services, startups can disrupt traditional banking and gain a competitive advantage.

- Supply chain management: Blockchain can enhance transparency, traceability, and efficiency in supply chain management. Startups can develop solutions that enable real-time tracking of goods, verification of product authenticity, and secure sharing of supply chain data among multiple stakeholders. This can help businesses streamline their operations, reduce fraud, and improve trust between participants in the supply chain.

- Energy sector: Germany is actively transitioning towards renewable energy sources and promoting decentralized energy systems. Blockchain can facilitate peer-to-peer energy trading, automate energy transactions, and enable secure and transparent tracking of energy generation and consumption. Startups can develop blockchain solutions that empower individuals and businesses to participate in the clean energy transition and optimize energy usage.

- Healthcare: Blockchain can enhance the security and privacy of health data, facilitate interoperability among healthcare providers, and streamline medical records management. Startups can create blockchain-based solutions for electronic health records, telemedicine, medical supply chain management, and patient consent management. Germany’s strong healthcare infrastructure and commitment to data privacy make it an ideal market for innovative blockchain healthcare startups.

- Government services: Germany has a robust public sector and is open to exploring blockchain technology for government services. Startups can develop blockchain solutions for identity management, voting systems, land registry, intellectual property rights, and public procurement. By leveraging blockchain’s immutability and transparency, startups can enhance trust, efficiency, and accountability in government processes.

- Internet of Things (IoT): The combination of blockchain and IoT can enable secure and decentralized communication, data sharing, and automation. Startups can create blockchain-based solutions for IoT device authentication, data integrity, and secure peer-to-peer transactions. As IoT adoption continues to grow, there is a significant opportunity for startups to provide secure and scalable blockchain solutions.

- Markets in Crypto Assets (MiCA): MiCA has the potential to be a major boost for Germany’s digital asset-focused companies. The regulation would create a level playing field for digital asset businesses, provide clarity for investors, and attract investment to Germany. This would help to create jobs and boost the German economy. In addition to the points mentioned above, MiCA could also help to legitimize the digital asset industry and make it more accessible to mainstream investors. This could lead to increased adoption of digital asset technology and increased demand for the services of digital asset-focused companies. As a result, MiCA could represent a major opportunity for Germany’s digital asset-focused companies.

- Web3: The development of Web3 startups and ecosystems in Germany has been growing rapidly in recent years. The country has a strong track record of innovation in the technology sector, and its regulatory environment is seen as being relatively favorable to the development of blockchain and decentralized finance (DeFi) technologies. As a result, Germany has attracted a growing number of Web3 startups and investors, and the country is now seen as one of the leading hubs for Web3 innovation in Europe.

Featured image credit: Unsplash