Intel has taken dramatic steps to restructure its operations, breathing new life into Intel stock price.

In the wake of a 7% increase in Intel stock, CEO Pat Gelsinger has outlined a series of ambitious changes aimed at reviving the company’s fortunes and positioning it for future success.

The focal point of this transformation is the establishment of Intel Foundry as an independent subsidiary, marking a significant milestone in Intel’s quest to regain its dominance in the semiconductor industry.

Foundry soars Intel stock prices

Intel’s decision to spin off its foundry business into an independent subsidiary is central to its strategy. Announced by Gelsinger earlier this week, the foundry business will have its own operating board and separate financial reporting.

The move is intended to give the foundry division the autonomy it needs to attract outside capital, focus on efficiency, and better serve customers. Historically, Intel has struggled to compete with other semiconductor manufacturers, but the hope is that greater independence will allow the foundry business to operate more flexibly and competitively in the market.

Panther Lake and Clearwater Forest, lead products on Intel 18A, are out of the fab, powered on, have booted operating systems, and are on track to start production next year. Additionally, Intel 18A has brought together two critical innovations to enable customers to make leaps…

— Pat Gelsinger (@PGelsinger) August 6, 2024

By giving Intel Foundry its own leadership and financial structure, the company is signaling a willingness to make hard choices in order to win back customers and investors.

One such customer is Amazon’s cloud services division, AWS, which has recently inked a multibillion-dollar deal with Intel Foundry for the production of custom artificial intelligence (AI) chips, as Reuters reports. Securing Amazon as a customer is a major vote of confidence and could be the catalyst Intel needs to rebuild its reputation in the semiconductor space.

Cutting costs and scaling back operations

While Intel celebrates its new deal with Amazon, the company is simultaneously making painful decisions elsewhere. In an effort to streamline operations and cut costs, Intel announced plans to halt work on new chip factories in Germany and Poland for the next two years.

These projects, which were originally conceived as part of a broader expansion strategy, have been postponed due to market conditions and expected demand. Instead, Intel will concentrate its manufacturing efforts on facilities in Arizona, Oregon, New Mexico, and Ohio, where it believes the return on investment will be stronger.

Moreover, Intel has revealed plans to significantly reduce its real estate footprint, cutting up to two-thirds of its global properties. This downsizing reflects Intel’s recognition of the need for leaner operations as it contends with rising competition and falling profitability.

The battle for AI supremacy

Intel is betting big on its 18A chipmaking process, a cutting-edge technology designed to produce faster, more efficient chips for AI and data center applications.

While initial testing of the 18A process has encountered difficulties, particularly in collaboration with Broadcom, Intel remains confident that it will be a game changer in the industry.

Intel reveals its AI roadmap with Lunar Lake at Computex 2024

In addition to its deal with Amazon, Intel has also secured Microsoft as a partner for its 18A process, further boosting optimism around the company’s AI capabilities.

AI chip production is quickly becoming a battleground for semiconductor manufacturers, and Intel is determined to remain at the forefront of this competition. With cloud giants like Amazon and Microsoft now on board, Intel’s AI ambitions appear to be on solid footing.

Financial challenges and turnaround efforts

Despite the promising developments in AI and foundry independence, Intel is still grappling with significant financial losses. In the first quarter of 2024, the company reported a staggering $1.6 billion in total losses, with its chipmaking division alone accounting for $7 billion in operating losses throughout 2023.

These figures have put intense pressure on Gelsinger to implement sweeping changes and drive greater profitability.

In response, the company has launched a comprehensive cost-cutting campaign that includes Intel layoffs affecting 15,000 employees worldwide.

Gelsinger has described this period as the most significant transformation in Intel’s history, comparing it to the company’s transition from memory chips to microprocessors in the 1980s.

Smoothly sailing with government support winds

Intel’s comeback effort has not gone unnoticed by the U.S. government. The company was recently awarded up to $3 billion in direct funding through the CHIPS and Science Act, a federal initiative aimed at boosting domestic chip production for critical industries, including the U.S. military.

Today, the Biden-Harris Administration and @DeptofDefense announced that @intel has been awarded up to $3 billion in direct funding under the CHIPS and Science Act for the Secure Enclave program – another step toward our shared goal of restoring American leadership in…

— Pat Gelsinger (@PGelsinger) September 16, 2024

The funding will play a crucial role in Intel’s plans to expand its manufacturing capabilities in the United States, further reinforcing its commitment to regaining leadership in the global semiconductor market.

Intel stock price chart says it all

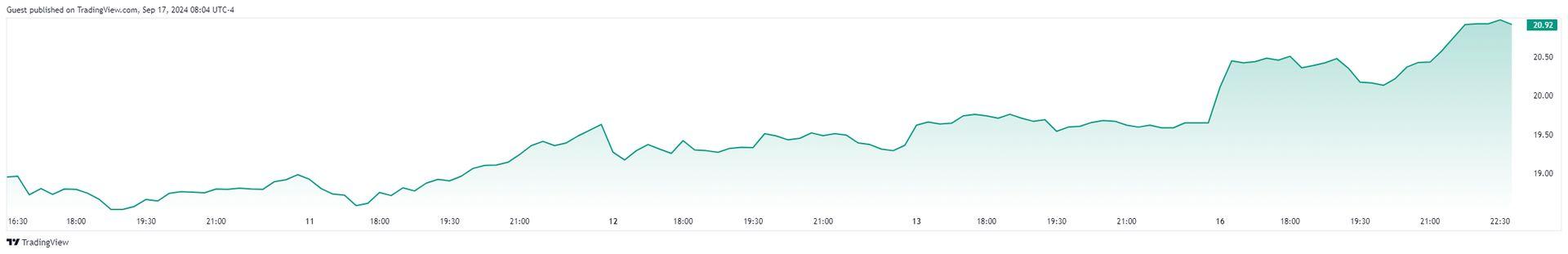

The Intel stock price chart reveals a steady, gradual climb over the past several days, culminating in a significant surge towards the end of the period, closing at 20.92. This consistent upward movement reflects the market’s growing confidence in Intel’s recent strategic decisions, particularly CEO Pat Gelsinger’s bold move to spin off the Intel Foundry as an independent subsidiary.

Intel stock has been under pressure due to its financial struggles, including billions in losses and significant restructuring efforts. However, the announcement of Intel Foundry’s independence, along with securing Amazon’s cloud division as a key client for its advanced AI chips, has renewed optimism. The chart clearly indicates that investors are reacting positively to these developments, as seen in the smooth yet solid upward trajectory starting mid-period, reflecting growing investor confidence in Intel’s turnaround plan.

Additionally, the chart displays several minor fluctuations, reflecting typical market volatility and investor caution. These smaller dips were likely influenced by Intel’s announcement to pause construction on its chip factories in Europe and real estate cutbacks. Yet, despite these temporary setbacks, the current Intel stock price shows a consistent recovery, which aligns with Intel’s broader efforts to prioritize its U.S.-based manufacturing plants and its shift towards AI-focused chipmaking.

The sharp rise near the end of the chart can be attributed to two major factors: Intel’s ambitious restructuring plans and the boost in market sentiment following Intel’s new AI chip deal with Amazon’s AWS. This surge signals that investors are confident that Intel’s strategic decisions will reverse its recent financial losses and drive future growth.

Intel on the rise, but challenges remain

Intel’s stock surge of 7% in the wake of these announcements signals that investors are cautiously optimistic about the company’s future. The decision to spin off Intel Foundry as an independent entity, secure major AI contracts, and scale back non-essential projects demonstrates a clear vision for revitalizing Intel’s operations.

However, the company is still navigating financial turbulence, and much will depend on how well these bold initiatives are executed in the months and years ahead.

With the semiconductor industry more competitive than ever, Intel faces a challenging road to recovery. Yet under Gelsinger’s leadership, the company appears to be making the right moves to rise from the ashes and reclaim its place among the top chipmakers in the world.

Featured image credit: Emre Çıtak/Ideogram AI