Decentralized Finance is reshaping the world in front of our eyes and is emerging from the shadows of the crypto world to challenge the established banks and financial institutions that have ruled the world for too long. In fact, according to DefiLlama there is $55.95 billion in value locked in DeFi platforms. The total value locked in decentralized finance as a whole has increased by over 5 times since July 2020, reported by Defi Pulse.

Forward thinking DeFi companies are entering the mainstream and giving the world a new form of financial services built on blockchain technology. Now, lending, borrowing, and trading can take place without a middleman. Unbanked individuals in the Third World can finally access a better life, not just dream about it, and the financial industry itself can tackle major issues like fraud and financial exclusion.

In a recent keynote at the Binance Blockchain Week 2024 conference in Dubai Richard Teng, CEO of Binance, explained the company’s mission for financial accessibility, “As many of you know, Binance started from very humble beginnings. Our journey began with a simple yet powerful mission: to make crypto – this revolutionary technology – much more accessible for everyone. Our mission is to spread the freedom of money far and wide.” Teng continued by sharing the growth the Binance has seen towards these goals, “In the first 9 months of 2024, Binance added 55 million new registered users, which is a 30% increase since the start of the year.”

The blockchain is just the start, of course. It’s a foundation, not the final building, and the industry is still working towards the financial model of the future.

So, what are the big DeFi trends in 2024 and beyond?

Layer 2 scaling solutions

One of the biggest problems right now is the throughput on the blockchains like Ethereum, which supports many DeFi protocols. Ethereum is seriously congested, like rush hour in Manhattan, and as more DeFi protocols and transactions come on stream, that could turn to gridlock. Scaling solutions can offer a respite for the congested blockchain without increasing block sizes.

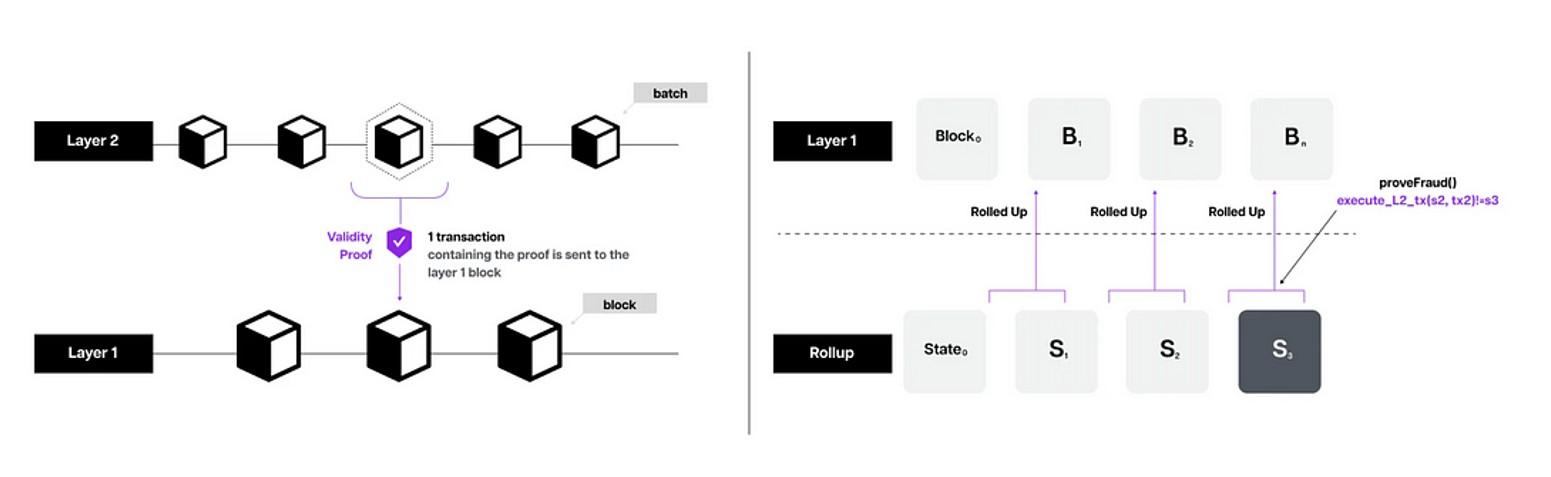

Layer 2 scaling solutions, like Optimistic Rollups and ZK-Rollups, can make the blockchain more efficient. ZK-Rollups, or Zero-knowledge rollups, are smart contract collateralized bundles of data on the main chain that are transported off-chain for processing and computing. They can produce a block in about a minute while processing 2,000 TPS. All verifiers can know they have the same information without it actually being disclosed due to Zero-knowledge.

Cross-chain compatibility

Not every DeFi platform lives on the Ethereum blockchain, and cross-chain compatibility is a real issue that needs to be tackled for mass adoption. Most applications are locked to their own ecosystem, and the likes of Binance Smart Chain, Ethereum and Polkadot don’t play together so well.

This is going to be an increasing issue, and that’s why developers are working hard on interoperability protocols to allow an application to work on multiple blockchains. It may sound like complex tech speak, but Polkadot’s Parachains, Cosmos’ Inter-Blockchain Communication (BC) and Thorchain are essentially translation tools that allow the blockchains to work together.

These bridges between the blockchains are an essential part of the process if the world at large is going to warm to DeFi, but goes well beyond mere asset transfer. It is crucial for achieving a truly collaborative and decentralized digital environment. The cross-channel communication capability will ensure that financial systems, digital identities and supply chains are interconnected to exchange value and data for increased liquidity, shared intelligence and improved security protocols.

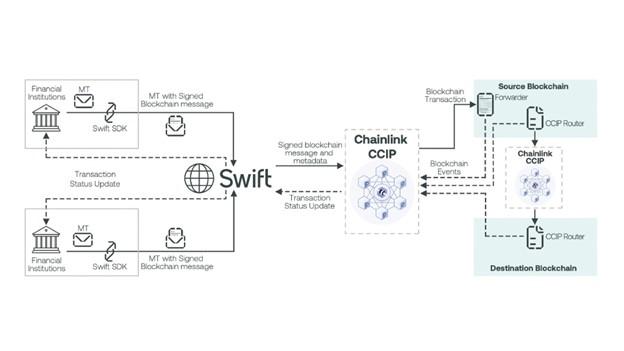

In a new report from Swift and Chainlink, the financial industry showcases their progress towards enabling interoperability between emerging blockchain networks and traditional financial systems by leveraging existing Swift infrastructure and Chainlink CCEP. This demonstrates the ability to transfer tokenized value securely and efficiently across private and public blockchain.

This collaboration marks the beginning of a single point of access for institutions to support and develop tokenized assets across multiple networks using existing secure infrastructure.

Blockchain gaming

Blockchain gaming is turning into a massive industry, and the DeFi market has started to monetize it. GameFi is the term that has evolved out of the DeFi being fully integrated into the gaming world.

‘Off the Grid’ has become a success and a pioneer for the blockchain gaming industry. These games allow players to own assets in the game itself and use tokens in the game’s ecosystem. We’ve seen this before; of course, many games have virtual currency. But these have actual value, and players can trade them on the DeFi network and earn interest. This way, players can also invest in the game itself in a next-generation form of crowdfunding.

The next evolution of GameFi is to integrate into the metaverse where games could be used to create virtual economies where players can earn rewards for their play in the form of NFT’s or tokens. DeFi protocols would be leveraged to power their virtual economies through access to financial services.

AI-powered DeFi

AI’s superpower is the ability to analyze incredible amounts of data to identify patterns and make predictions. This type of data enhancement can empower DeFi solutions to significantly enhance security, optimize operational efficiency and personalize services to the end user.

Specifically, AI can help by automated trading algorithms, smart contract auditing and fraud detection systems making financial products and services more efficient, fair and accessible. For example, AI can automate the creation and execution of smart contracts in DeFi by leveraging NLP and machine learning. This can in turn facilitate the development of self-executing contracts which improves the accuracy of contract terms and operations.

Institutional adoption

Until now, DeFi has been growing without significant investment or involvement from institutional money. As part of the mass adoption process, get ready to see an influx of hedge funds, asset managers and traditional banks.

The delay in this investment comes down to regulatory concerns by institutions who are legally required to follow protocols like know-your-customer (KYC) and anti-money laundering (AML). While digital assets were created as trustless technologies in order to preserve privacy, compromise is required for the underlying technology to be useable by these institutions.

In response to these regulatory uncertainties, many in the crypto industry are investing heavily in infrastructure that can address these concerns. Zero-knowledge proofs (ZKP’s) offer institutional DeFi a mechanism to balance compliance and privacy through cryptographic verification means. This enables non-custodial operations that streamline identity verification while mitigating data breach risks.

Decentralized identity and KYC integration

A decentralized Know-Your-Customer (KYC) system could be the potential solution that keeps institutional investors happy, and serves a purpose for the general population.

We have to prove who we say we are all the time at the moment. Everything from a cellphone contract to a big win at an online casino requires stringent KYC verification. The blockchain could provide a simple solution with verifiable credentials that mean we’ll never have to send a copy of our passport to anybody ever again.

This system would also mean the blockchain verifies your information without releasing it to the other party. That’s much more secure and will put an end to data leaks that happen too often right now and endless privacy policies.

Liquid staking protocols

Liquid staking protocols mean you can lock up your assets in staking and yet still retain your liquidity. It’s like Schroedinger’s staking, almost like a secured loan against your locked-up assets in the form of Liquid Staking Tokens (LSTs).

Of course, these are backed by smart contracts and act as a derivative of the staked asset, but holders can then use these tokens for continued DeFi activity. So, they keep the market fluid and moving.

Featured image credit: Shubham Dhage/Unsplash