Firefly Neuroscience, Inc. (NASDAQ: AIFF) shares surged by 211.3% on Tuesday following the announcement of the company’s acceptance into the NVIDIA Corporation Connect program.

Firefly Neuroscience shares soar 211.3% after NVIDIA program acceptance

Firefly plans to utilize the program’s tools and resources to support its initiative focused on developing a proprietary foundation model of the human brain. The NVIDIA Connect program offers benefits including technical training, engineering guidance, and discounts on NVIDIA software and hardware to expedite development and increase efficiency.

Greg Lipschitz, Executive Chairman of Firefly, stated, “This marks the achievement of an important milestone for Firefly and comes at an extremely opportune time. As our already unparalleled BNA™ database continues to grow with each new clinical study and/or clinical assessment in which our technology is used, and we have gained vital access to the best hardware and latest resources through the NVIDIA Connect program, we believe that Firefly is now uniquely positioned to build the world’s first foundation model of the human brain.”

The growing demand for energy due to the rapid expansion of AI technology presents challenges regarding power availability, grid capacity, and sustainability. Experts emphasize the pressing need for reliable electricity sources as tech giants invest in large-scale data centers, highlighting the urgency of expanding power generation and upgrading infrastructure while balancing AI growth with clean energy goals.

Firefly Neuroscience develops AI-powered neuroscientific solutions, including its Brain Network Analytics software, which aids in diagnosing and treating mental illnesses and neurological disorders. The company’s recent acceptance into the NVIDIA Connect program, announced on February 11, enhances its capabilities to advance neurological and mental health innovations through AI-driven methodologies.

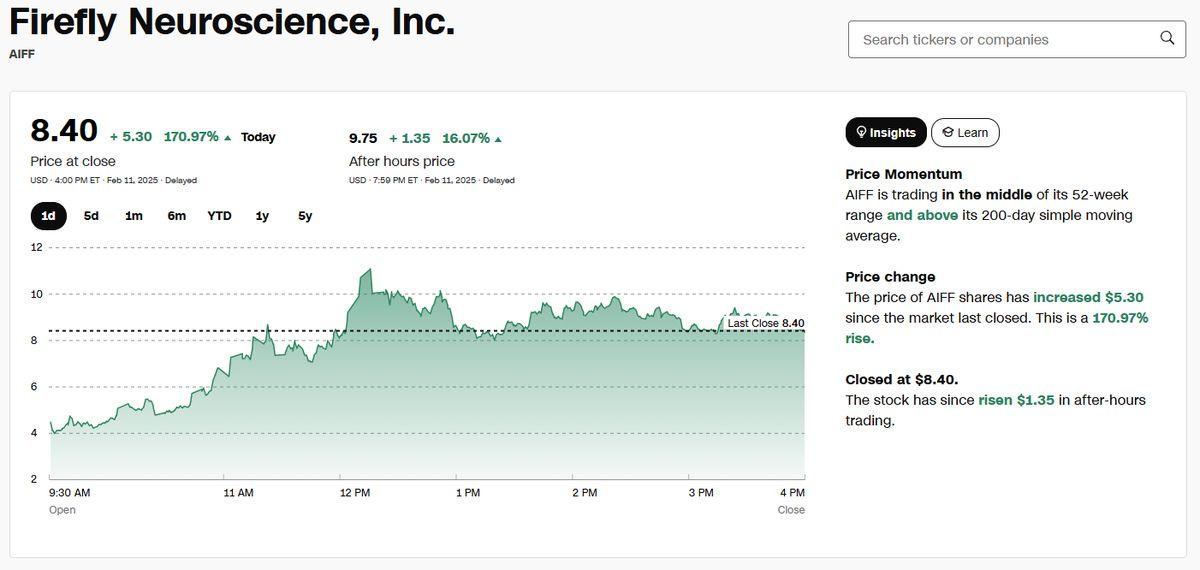

Currently, Firefly shares are trading significantly higher at $8.40.

AIFF’s 200-day Simple Moving Average (SMA-200) is $4.79, indicating a key support/resistance level.

Valuation ratios:

- Price-to-Sales Ratio: 5.28 (last 12 months).

- Price-to-Book Ratio: 15.45 (most recent quarter).

- Price-to-Cash per Share: 33.20.

Analyst ratings: AIFF’s rating trends are unknown, but market analysts typically score stocks on a 1-5 scale (1 = strong sell, 5 = strong buy).

Ownership structure:

- Insiders own 68.85% of shares.

- Institutional ownership is 1.76% of total shares and 5.66% of the float.

- Top Institutional Holders:

- Geode Capital Management: Holds 57.36 shares (0.72%), valued at $0.27M (as of Sep 30, 2024).

- Millennium Management LLC: Holds 56.93 shares (0.72%), valued at $0.27M.

Trading volume & moving averages:

- 20-day average volume: 8.83M shares, moving average: $3.55.

- 50-day average volume: 3.67M shares, moving average: $3.07.

- 100-day average volume: 1.96M shares, moving average: $3.19.

The stock has experienced high volatility, significant insider ownership, and low institutional backing. Investors should watch technical levels and market sentiment before making decisions.

Disclaimer: The content of this article is for informational purposes only and should not be construed as investment advice. We do not endorse any specific investment strategies or make recommendations regarding the purchase or sale of any securities.

Featured image credit: Firefly Neuroscience